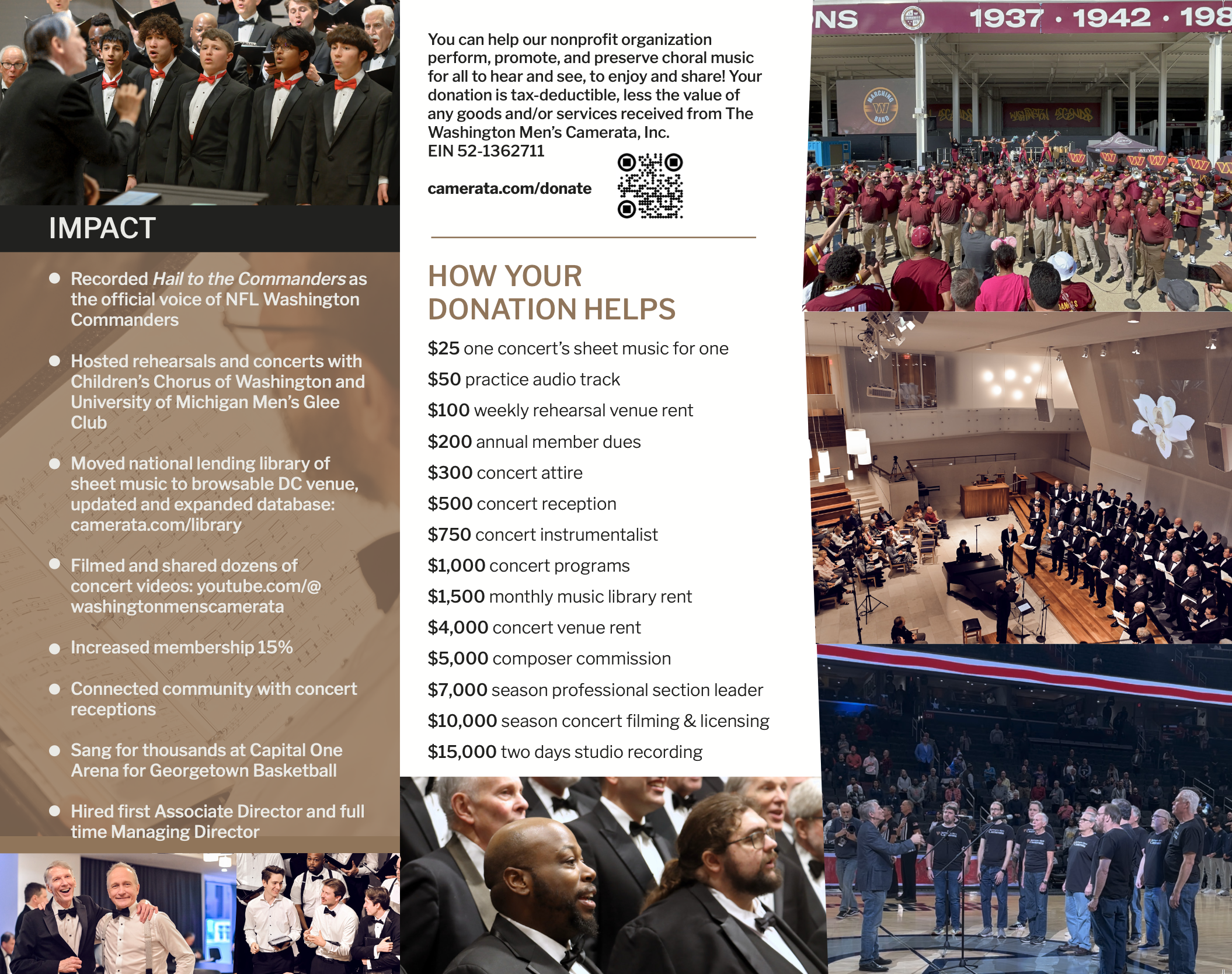

The Camerata thrives because of you! Over 90% of our support comes from generous donors, enabling us to continue our mission of creating exceptional choral experiences and making a lasting impact in our community. Your gift keeps extraordinary choral music alive and accessible, inspiring audiences and nurturing the next generation of musicians. Choose a recurring gift to sustain music all year long. Double your impact with a match from your employer. Ask them about your options or ask us to research it for you.

Every donation helps us:

• Present powerful performances that move and unite our community

• Preserve and expand our music library

• Support music education and outreach programs

• Cover essential costs like venues, staff, music, and recording

Give as a Company Sponsor

Sponsor a concert, initiative, education, community participation, or an entire concert season, and gain visibility among engaged audiences, demonstrating a commitment to the arts. We'll share about your support in concert programs, event displays, e-newsletters, website, social media, and many other options available to your company and employees.

• $500 – Friend of the Camerata

Support community engagement and access for local audiences.

• $1,000 – Concert Supporter

Help cover the costs of free student tickets and music education outreach.

• $2,500 – Series Sponsor

Fund rehearsal and performance expenses, ensuring high-quality artistic programs.

• $5,000 – Season Sponsor

Provide direct support for professional musicians and commissioned works, sustaining artistic excellence.

LEARN MORE

Give through a Donor Advised Fund

A DAF charitable savings account gives you the flexibility to recommend how much and how often money is granted, and you qualify for a federal income tax charitable deduction at the time you contribute to the account. Donors can contribute to the fund as often as they like.

Give through your retirement account

Consider naming us a beneficiary, or make a charitable rollover gift from your IRA without it being treated as a taxable distribution.

Give through securities

Transferring ownership of appreciated securities like stocks, bonds, and mutual funds could give you a charitable deduction for the full market value without capital gains taxes (subject to IRS deductible limitations).

Connect with our Managing Director at 202-364-1064 or managingdirector@camerata.com.

Your donation is tax deductible provided you have not received any goods or services in exchange. Our EIN is 52-1362711. Contact your legal, tax, or financial advisor for eligibility and planning.

We're proud to be recognized with a Candid Seal of Transparency, demonstrating our commitment to openness and making our work more visible across 200+ platforms.